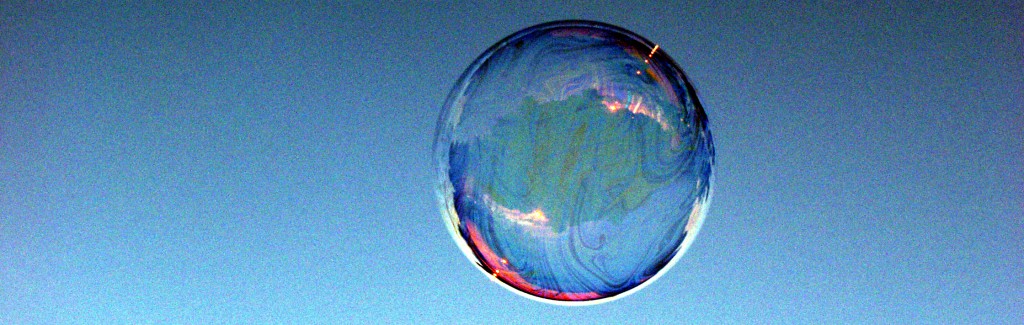

Will it ever end? The Canadian Centre for Policy Alternatives just came out with their report that states ”Canada is experiencing, for the first time in the last 30 years, a synchronized housing bubble across the six largest residential real estate markets in Canada.” You can find the full 24 page report at www.policyalternatives.ca.

The author of the report, David MacDonald, provides three different scenarios a) a market correction through straight pricing deflation of homes b) a deeper and longer crash over several years with prices dropping each year, or c) a rapid and steep decline similar to the US. The biggest problem I see with this report is that it is grouping all the cities together and all having the same issues.

Due to Canada’s size and diversity, what happens in one region doesn’t necessarily affect another. Alberta as an example always lags behind other provinces initially as overall economic growth increases. Then due to our energy based economy it surges above and beyond the other economies after the demand factor increases. Ontario on the other hand often starts strong due to increasing manufacturing. As for specifically Vancouver, it seems to operate under its own set of universal laws as there is no way people can afford to buy homes there, yet it continues merrily along.

Now, having said that, we are also all tied together with certain aspects, such as mortgage rates, which David also says will play a factor. I absolutely agree with him that if mortgage rates return close to historic norms too quickly it will have a dramatic affect on affordability. This is why I have been surprised by the previous two rate hikes the Bank of Canada already instituted this year. It’s also something that the finance minister is paying very close attention to at this point.

They are very aware that if they continue to consistently increase rates, even at a slow pace, it will dramatically affect the entire economy. As I have pointed out in previous articles, Canada had been the only G7 country to increase rates and we were only able to do so due to our quick recovery from the global slowdown. This was predominately due to many of the economic policies Canada had in place along with our stricter lending practices. Many other mortgage rate watchers, as well as myself, believe that if we do see further increases they will be very minimal and rates will stay very close to where they are currently at for a while. The caveat being if the economy starts to grow like crazy, increasing rates will just keep everything in balance.

Overall, he makes many good points and provides several possible outcomes. The unfortunate points being he doesn’t look at any of the positive signs we see out there which point to the market possibly dropping still a bit more, but regaining strength as we move into the end of 2010 and into a positive looking 2011.

Just to close off, the same day the above mentioned report came out, a report from C.D. Howe also came out. It took the stance that there is no indication that Canada will suffer a US style housing crash. Also a good read, it just didn’t get much press because it may perhaps have been to positive and positive headlines just don’t sell!

Bill,

The CCPA report bases their forecasts on some concerning assumptions that need to be weighted against reality. Most notably, the fact that rising interest rates WILL impact house prices and affordability is a given. The probability of rising rates beyond that necessary to maintain inflation remains to be seen. On a global stage, the BoC has many critics, and I believe would choose to remain cautious about sparking a boom while we diligently work through the current slump cycle. I guess I don’t see Carney as the trigger-happy type! The second assumption the CCPA is making is that there WILL be a bubble. They don’t entertain the possibility of a typical slump progression, but rather support their hypothesis on a certainty I believe they cannot support. My 2 cents…

It’s incredibly easy to make arguments work in your favour when you base it on one factor. In this case as you pointed out interest rates. I can counter that with this alternative, if the government decides everyone gets a mandatory yearly government check of $100,000 that house values won’t decrease, but instead will go up! Of course the odds of my argument coming true is only slightly more askew than the government raising rates without considering the results.